Introduction to Simple interest:

Table of Contents

First we need to understand what is interest? Interest is the extra money that is paid to the lender of money for using his money, in another word, interest is the cost of borrowing money. Interest may be either Simple interest or Compound interest.

Simple Interest is the interest which is calculated on the principal for a given period of time. In simple interest Interest remain same for every year.Formula to calculate simple interest is,

Principal

Principal is the money which is given or taken as loan or the money which is deposited into a bank.

For Example: Mr Karim opened a bank account in BANK OF INDIA and deposited Rs 10,000 in that bank. He got 10200 after 2 year

Here Rs 10,000 is the principal as this is money he deposited in the bank and 200 is interest,

Time

Period for which loan is taken or time for which money is deposited in the bank.

In the above example, 2 years is the period for which money was deposited in the bank.

Rate of Simple Interest

The amount of interest on Rs100 for a given period of time is called Rate of Simple interest.

for Example : “Rate of simple interest 5% per annum” means that interest on Rs 100 in 1 year is Rs 5.

Amount

Principal along with interest is called amount.

For example: If I have deposited INR 10000 for 5 year at the rate of simple interest 5% per annum. After 5 year I get 12500. This 12500 will be called amount. Here Rs 12500 include principal i.e 10000 and 25000 simple interest.

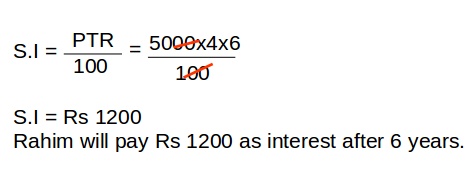

Examples: 1

Rahim has taken Rs 5000 as loan from a bank at the rate of 4% p.a simple interest. How much will he pay after 6 years as interest?

In the above example

Principal=5000

Rate of Interest (R)=4% p.a

Time(T)=6 years

In the above example

Principal=5000

Rate of Interest (R)=4% p.a

Time(T)=6 years